us germany tax treaty limitation on benefits

Germany and the United States have been engaged in treaty relations for many years. If you claim treaty benefits that override or modify any provision of the Internal Revenue Code and by claiming these benefits your tax is or might be reduced you must attach a fully completed Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701b to your tax return.

The US-UK competent authority agreement on Brexit confirms that post-Brexit a UK resident is a resident of a Member State of the European Community for purpose of.

. This alert concerns one discrete issue that has not yet been decided by the US. It is 1 an individual. Germany - Tax Treaty Documents.

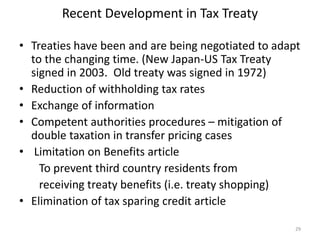

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Limitation on benefits clauses are drafted with the intention of avoiding treaty shopping whereby a third-party national or corporation sets up a shell company in a contracting state through which income will be. The complete texts of the following tax treaty documents are available in Adobe PDF format.

Residence alone however is not sufficient. The treaty has been updated and revised with the most recent version being 2006. See Article 10 10 of the United States- Germany Income Tax Treaty.

Residents who are individuals of one of the Contracting States or political subdivision thereof are generally not affected by the Limitation on Benefits article. The treaty permits a reduction of the 30 percent branch profits tax to 5 percent or lower on the dividend equivalent amount. Treaty shopping generally refers to the acquisition and enjoyment of treaty benefits under a given tax treaty by persons who are not bona fide tax residents of one of the countries that is a party.

Clause has been included in the tax conventions and treaties to which the United States is a party. Limitation on Benefits Provisions. To qualify for treaty benefits under the derivative benefits test a specified percentage typically 95 percent of an entitys shares must be owned directly or indirectly by seven or fewer.

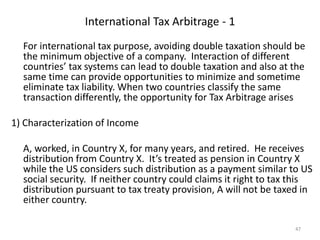

LOB provisions are intended to prevent so-called treaty shopping arrangements where artificial structures are used to gain access to favourable tax treaties that would not otherwise be available. The Canada-United States Tax Treaty the Tax Treaty is unique among Canadas tax treaties in its approach to prevent treaty shopping. Tax treaties generally contain a limitation-on-benefits LOB article that is intended to ensure that foreign entities only receive treaty benefits if they are sufficiently connected to one of the.

In the Federal Republic of Germany this will include. Significantly expand the limitation on benefits clause to address treaty shopping would re-source as German-source income otherwise US-sourced income that is subject to German tax under the Treaty and would introduce mandatory binding arbitration in certain cases where the competent authorities of the two countries cannot come to an agreement. The first test was the automatic qualification test.

Withholding tax applies to payments of US. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Even the title causes confusion as it is often referred to as the Limitation of Benefits sometimes even by the people who negotiated it.

Residents of a country whose income tax treaty. While US tax treaties are very comprehensive on many different types of tax matters it is also important to note that there are many crafty taxpayers who are masters at. The Convention further provides both States with the flexibility to deal with hybrid financial instruments that have both debt and equity features.

Tax treaties are generally intended to confer benefits upon residents of the United States and its treaty-partner country. Tax Treaty Limitation on Benefits LOB Form W8-BEN-E Generally a 30 US. Shareholders will no longer be considered equivalent beneficiaries for purposes of the.

To restrict benefits a limitation on benefits clause has been included in the tax conventions and treaties to which the United States is a party. There is one particular provision within what is already a complex treaty that warrants its own article and this is Article 23 Limitation on Benefits LoB. These treaties also require that if the qualifying countrys treaty with the United States has no LOB provision the equivalent beneficiary would be entitled to treaty benefits only if it qualified under one of the four tests described above ie.

Limitation on benefits clauses are drafted with the intention of avoiding treaty shopping whereby a third-party national or corporation sets up a shell company in a contracting state through which income will be. Tax treaty with the United States contains a Limitation on Benefits article are eligible for benefits only if they satisfy one of the tests under the Limitation on Benefits article. In keeping with this rationale US.

Treaty Rates for Interest. 3 publicly traded entity. Since this first Limitation of Benefit clause which included almost all modern limitations and was considered as a highly innovative clause was introduced in the US- Germany tax treaty.

Limitation on Benefits PDF. In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits. Article 11 of the United States- Germany Income Tax Treaty deals with the taxation interest.

You can obtain the full text of these treaties at United States Income Tax Treaties - A to Z. In order to enjoy the benefits of a US. Sourced income made to foreign persons.

The Limitation on Benefits LOB article is an anti-treaty shopping provision intended to prevent residents of third countries from obtaining benefits under a treaty that were not intended for them. Income tax treaty a person must satisfy a number of requirements including residence in one of the treaty countries. See Exceptions below for the situations where you are not required to file Form 8833.

Or 4 a pension fund or other tax-exempt entity as set forth in the treaty. The United States is a party to numerous income tax treaties with foreign countries. Under this clause there were three alternative methods through which an individual or entity could qualify for tax benefits.

If the foreign person qualifies for benefits under an income tax treaty with the US the withholding tax rate may be reduced. What is a Limitation on Benefits LOB Provision in Tax Treaty. This restricts the availability of benefits such as reduced dividend withholding tax rates provided for by the treaty.

Whether the United Kingdoms withdrawal from the European Union means that UK. International tax treaties a re designed to facilitate tax compliance between the two contracting country parties to a specific tax treaty agreement. Treasury but that could have dramatic consequences for entities currently claiming the benefit of US.

The United States is very concerned about treaty shopping. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. The USUK tax treaty includes in Article 23 a limitation of benefits provision that is intended to prevent treaty shopping by residents of third countries attempting to obtain benefits under the treaty.

German Law Removes Us S Corporation Tax Benefit

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Corporate Tax Report 2022 Germany

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Federal Tax Benefits For Manufacturing Current Law And Arguments For And Against Everycrsreport Com

German Law Removes Us S Corporation Tax Benefit

Tax Incentives For Investment In Developing Countries In Imf Staff Papers Volume 1967 Issue 002 1967

Hungary Taxing Wages 2021 Oecd Ilibrary

Benefits And Hazards To Stakeholders Of Corporate Tax Competition Download Table

United States Germany Income Tax Treaty Sf Tax Counsel

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

Taxation Changes In Indonesia Under Tax Regulation Harmonization Law

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog